Father and Son — Fellow Students at Maryville

Sam Slaughter is a nursing student on campus, while his dad, Kelly Slaughter, studies for his MBA online

Read ArticleRecent Posts

Annual Staenberg Lecture to Feature Award-Winning Author Dara Horn

Three-time National Jewish Book Award recipient will headline the third Annual Staenberg Lecture on April 15, in partnership with the St. Louis Kaplan Feldman Holocaust… Read More

Brian Owens to Headline Kids Rock Cancer Mother’s Day Benefit Concert

Maryville University’s Kids Rock Cancer is an innovative program that helps children manage the unique emotional challenges caused by cancer or blood-related disorders—whether they or… Read More

From Summer Camp to Studio

Maryville’s CA2 program expands into brick-and-mortar space, readying young minds for an open-ended future. Inside a space once known for dozens of retail stores and… Read More

Lifting Voices and Raising Community

The Maryville University Gospel Choir is singing again, connecting the campus community through music. Damon Mitchell, development director of outreach programs, believes you should use… Read More

Faith as a Complex Ecosystem

Kyra N. Krakos, associate professor of biology and director of the sustainability program at Maryville University, teaches us that, yes, you can pet a bee,… Read More

Maryville Celebrates a Decade with Rawlings

Commemorating a Partnership That's Changed the Face of Sport Business (Note: This article originally appeared in the Spring/Summer 2023 issue of Maryville Magazine) For over… Read More

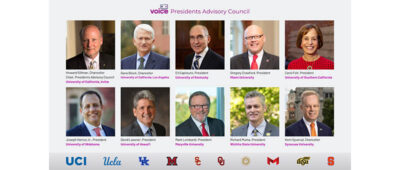

Dr. Lombardi Joins the Presidents Advisory Council of VOICE

Mark Lombardi, PhD, President of Maryville University, has joined the Presidents Advisory Council of Voice of Intercollegiate Esports (VOICE), a nonprofit member organization building an… Read More

Dr. Kyra Krakos Discusses Goat Day on the Maryville StoryCast

Goat Day was practically a Maryville national holiday back in the 2010s, a demonstration project designed to show our students different ecologically sustainable methods for… Read More

New Federal Designation for Cybersecurity Program

A “crowning achievement” for Maryville brings opportunities for students. Maryville students, faculty and alumni are celebrating a new classification establishing the University’s cybersecurity program as… Read More

Maryville Announces $21 Million Investment in AI and New Technologies Amidst Record Growth

Maryville’s substantial investment strives to keep the university’s future cemented for years to come [St. Louis, MO, February 14, 2024] – In a bold move… Read More